Loft spaces in London frequently need to be valued where the leasehold owner of the top floor flat looks to extend up into the space but cannot do without paying their freeholder a premium.

Both parties will need to establish if the leaseholder owns the loft space as in the majority of cases it will not fall within their demise and is therefore owned by the freeholder.

Even if the space is clearly within the leaseholder’s demise, they will also have to own the roof structure itself and be free of any restrictive development covenants. From our experience, this scenario is very rare which moves us onto how the space is valued.

What can be Built

It is an important starting point to to establish is whether the space could developed as a new separate flat or just as an extension to the existing upper flat.

Points to consider are whether there would be a means of access if the space were to be developed as a separate dwelling and even if there was, is the development viable from a planning point of view? The cost of complying with Building Regulations may also make the cost of developing a new dwelling too expensive.

In most cases the development will only be viable as an extension to the top floor flat.

Market Value or Marriage Value

The definition of ‘market value’ is as follows:

The estimated amount for which an asset should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without compulsion.

Whilst market value is used to determine the before and after values of the property, it is not suitable to provide a value of the space itself as there is no sales data for such transactions.

The approach that we adopt is one of added value. The principle is the same as when a leaseholder pays compensation to their landlord in return for granting an extension to the term of their lease. Once the existing term of the lease is added to the additional term the property becomes more valuable and is called ‘Marriage Value’.

Methodology

The value of the property before and after works will need to be valued by a surveyor. From this uplift in value, costs are deducted to derive a profit

The cost of the work should include any alterations that are necessary to the communal areas or any of the other leasehold flats in the building and professional fees including the estimated costs of complying with the Party Wall etc. Act 1996.

On typical cost is one that acknowledges the fact that the leaseholder is shouldering all the risk of the development, whilst the freeholder is exposed to none. If the premium for the loft space is paid in advance of the works being completed (and it usually is), then the project has to run precisely to plan, time and cost for the valuation to be correct. A 10% downwards adjustment is typical on simple jobs and reflects the likelihood of the project coming in at more than would have been expected.

There would be a reasonable case for the adjustment to be greater if the project was more bespoke.

There is a lot of subjective opinion when it comes to valuations of this type, so it is not unusual for both the leaseholder and the freeholder to instruct their own separate surveyors and to have a period of negotiation. Other freeholders are more relaxed and are happy to commission only one surveyor and one report. In that instance it is preferable for the Valuer to clearly state in their T&Cs that both the leaseholder and freeholder are clients and that the report represents his impartial opinion and act as a Single Joint Expert.

Contact Us

Peter Barry’s Chartered Surveyors have valued large numbers of loft spaces across London as well as other types of spaces including vaults and communal areas for development. If you are considering works of this nature please get in touch.

Recent Case Study

We recently made a loft space valuation in Hartfield Road SW19 and you can read all about it in our latest case study.

View Case StudyWhat are my options for my loft extension

Of all the types of property extension the conversion of a loft space is one of the more affordable. So, what are the various types and what do they typically cost?

Read BlogLOFT SPACE VALUATION FAQs

WHY DO I NEED MY LOFT SPACE VALUED?

Unlike freehold ownership when you own a house, leasehold ownership comes with numerous requirements and restrictions on what you can do with your flat and that includes the manner in which you can extend it.

The vast majority of top floor flats do not have the loft space above them included in their demise so need to pay a premium to acquire and convert it.

MY LEASE INCLUDES THE LOFT SPACE. DO I STILL HAVE TO PAY TO CONVERT IT?

Unfortunately, ownership is only part of the equation and is something we have covered in this blog. Some leases will have covenants restricting alterations but unless you also own the physical roof above the loft space, a premium will be payable to your freeholder.

Our surveyors at Peter Barry can read your lease and offer you an initial assessment of your rights, but you may need to seek proper legal advice for definitive confirmation.

THE ONLY ACCESS TO THE LOFT IS VIA MY FLAT. HOW CAN IT HAVE ANY VALUE TO MY FREEHOLDER?

A loft space accessed only in this way is common to 99% of converted properties in London. Value is a product of the demand of the leaseholder to develop the space and the ability of the freeholder to withhold permission.

In a scenario where there is only one buyer and one seller, it is accepted that any (hypothetical) profit from the build is split 50/50 between the leaseholder and the freeholder.

WHAT DO I NEED TO GET A VALUATION?

We can work with both substantial and minimal information.

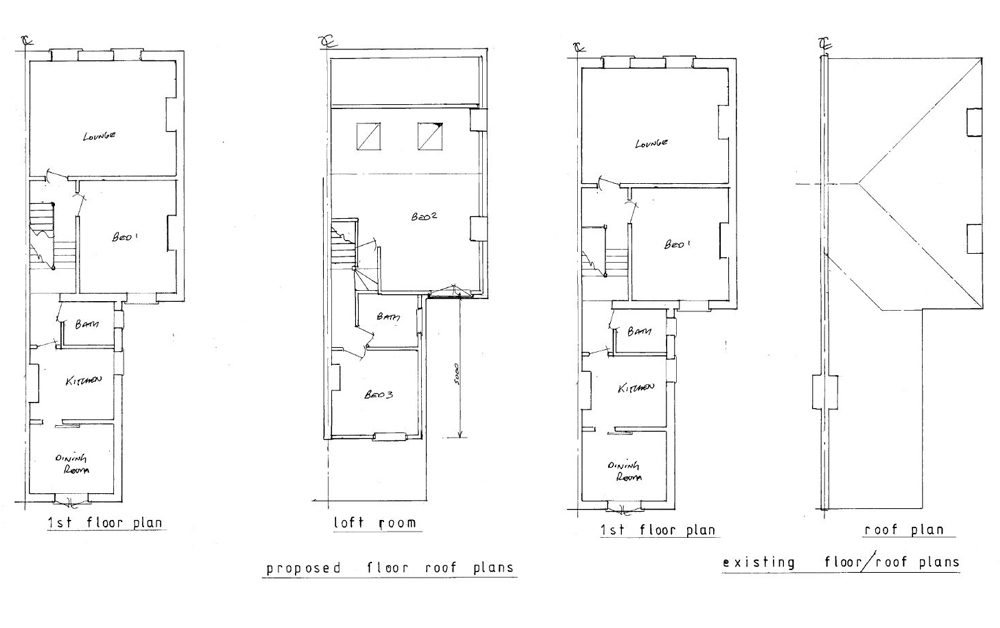

In an ideal situation you will already have drawings from an architect, some form of cost estimate, preferably a quote from a contractor and a summary of professional fees such as engineering and solicitors. Our job is to value the property in it is existing and proposed form, to which we apply the above.

We also recognise that many clients need an idea of the cost of acquiring the loft before they incur these expenses, so in instances where the property is a common building type such as a Victorian terrace, we can search the Council’s planning portal so examples of possible types.

We can then estimate the build cost based on our experience of similar conversions.

WHAT COSTS DO I NEED TO CONSIDER?

Aside from the more obvious architectural plans, you will need to consider:

- A planning application if outside permitted development

- An Engineer

- A Solicitor

- A Surveyor and Solicitor for License to Alter

- Party Wall Matters